View our tax return checklist for individuals, available in print format or online!

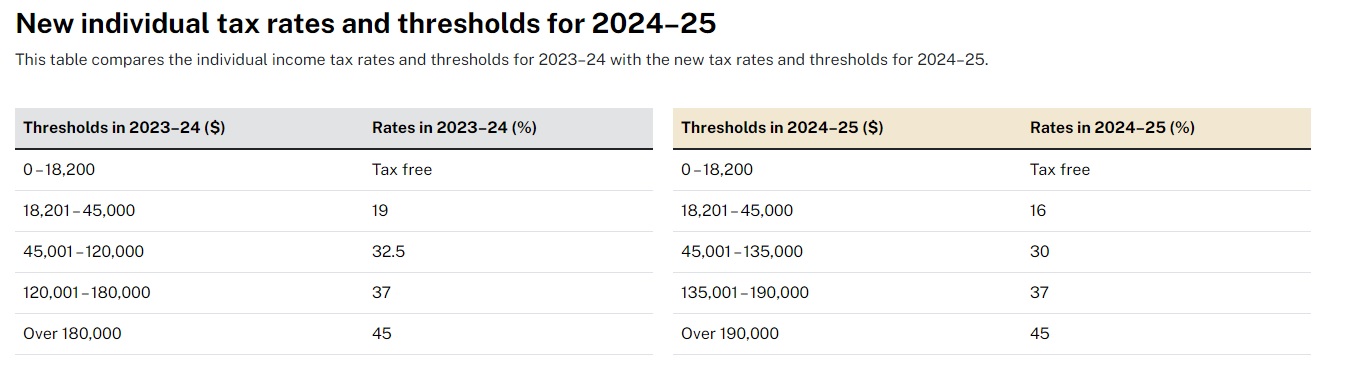

From 1 July 2024 the tax rates for individuals will be reduced. Depending on your income level, you will keep more of your pay each pay period as less tax will be deducted from your pay. For more information please visit

Every year the ATO target specific areas of tax returns to ensure you are compliant.

It is now mandatory to keep a record of your working from home hours. To make a claim for the 23-24 year, there are two requirements you

must meet.

Rental properties are on the watchlist AGAIN in 2024. Especially deductions. Have a look at the comprehensive list the ATO has

published for rental properties.

They will be looking at returns lodged in July 2024 as these returns are generally missing income from other sources.

In Conjunction with the Working From Home claim, the ATO are looking at work-related expenses.

From 1 June 2023 HELP Debt Indexation has been reduced, from 7.1% to 3.2% in 2023, and 4.7% to 4% in

2024.

The instant asset write-off threshold for small business will be $20,000 from 1 July 2023 to 30 June 2024.

Superannuation Contribution Guarantee for employees is increasing from 11% to 11.5% from 1 July 2024.

Most software will update this automatically, please check your pay run to ensure you are paying super at the correct rate.

Effective from 1 July 2024, The FairWork Commission has announced the following wage increases:

These increases apply from the first full pay period starting on or after 1 July 2024.

Check your Award on the FairWork website now.

From the 2023-2024 income year, non-charitable not-for-profit's (NFP) with an active ABN are required to lodge an annual self-review

return, to assess their eligibility for an income tax exemption.

Self-review returns can be lodged online, using Online Services for business, or through a registered tax agent.

Click here for more information.

If you missed our seminar on your reporting obligations, please see below our helpful documents.

We'd like to congratulate the following staff on their service with Galpins.

Admin

Director

Accountant