Galpins is in the process of adopting a new online fee payment system. This system will provide a simple and convenient way for you to pay fees due online (including fee free payments from your nominated bank account) via your computer or smartphone.

Once the system is implemented, our clients will be informed by email each time a new fee invoice has been issued. Clients will be similarly notified if they have any outstanding fee invoices via email and SMS. These communications will contain a link to the Galpins secure payments' portal, allowing you to pay directly from the SMS or email. Additionally, clients will be able to pay by clicking the “Client Payment” button on our website.

You will also have your own online payment portal that will allow you to view all your invoices from us and any payments you make.

Are you ready?

Tick this one off your list.

As of 1 July 2019, all businesses with employees will need to start using Single Touch Payroll. The ATO have allowed until the 30th

of September 2019 to get organised.

More information on STP from the ATO can be found here.

Select your software below for instructions on how to begin STP Reporting. Using another form of software? Contact Us

Currently not using software? We can help! There are a few solutions to suit your circumstance! Galpins Payroll, or contact us to discuss your options.

The instant asset write off has been increased!

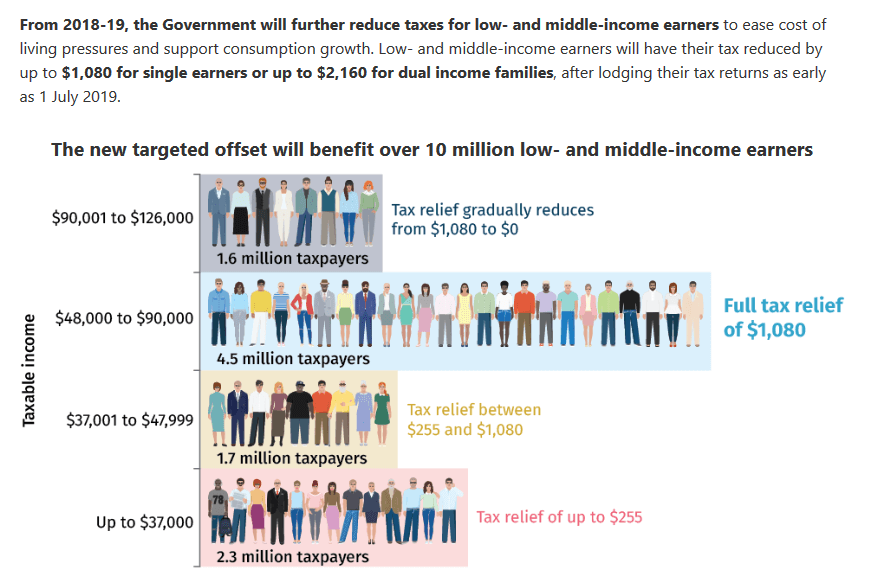

Additional tax relief for low to middle income earners!

The low and middle income tax offset (LAMITO) of up to $530 was passed in the 18/19 budget. The 19/20 budget has proposed to increase this from $530 to $1,080.* See where you fit in below!

*To take full advantage of the tax offset, we suggest to wait on lodging your tax return until the increase has been determined by parliament.

As of 1 July 2019, employers are no longer obligated to provide PAYG Summaries at the end of financial year.

You can access a year to date summary through your myGov account.

Private health insurers are no longer required to send statements unless requested. This information will be

prefilled by the ATO in your tax return.

From 1 July 2019, the minimum wage will increase by 3%. This increase applies from the first FULL pay period

in July.

From 1 July 2020, land owners will pay land tax on the TOTAL value of land held, regardless of ownership structure.

This will allow two or more entities to be grouped together for land tax purposes. The marginal land tax rate will be reduced by 0.1% each year from 3.7% in 19/20 to 2.9% in 27/28

As of 1 July 2019, super fund accounts that are ‘inactive’ for 16 months, the fund will cancel any insurance cover you may have, unless you take action and confirm you’d like to keep it.

You should have received a notification to Opt-In from your super fund if you would like to keep your

insurance.

From 1 July 2019 the threshold for repayments of student loans as decreased from $55,873 to $45,881. If your taxable is above $45,881 you will be required the pay a percentage of your loan back.

If you will earn over $45,000, talk to your employer about withholding more tax from your pay.

We recently held 3 events in Mount Gambier with guest speakers from Return to Work SA, MYOB, the ATO and the City Football Group! We would love to hear your thoughts about future events you may be interested in.

Auditor

Nikki joined our team in January 2019 as an Intermediate Auditor, she holds a Bachelor of Commerce and has recently completed her CA!

Auditor

Jagjit also joined our team in January 2019 as an Auditor with a Masters of Professional Accounting.

Auditor

Anita only recently joined our team as a Senior Internal Auditor with a Bachelor of Law and Legal Practice.

Auditor

Kevin joined our auditing team in April 2019 with a Masters of Professional Accounting.

Analyst

Accountant

Accountant

Accountant